How To 1040ez Form Form Typer Online?

Easy-to-use PDF software

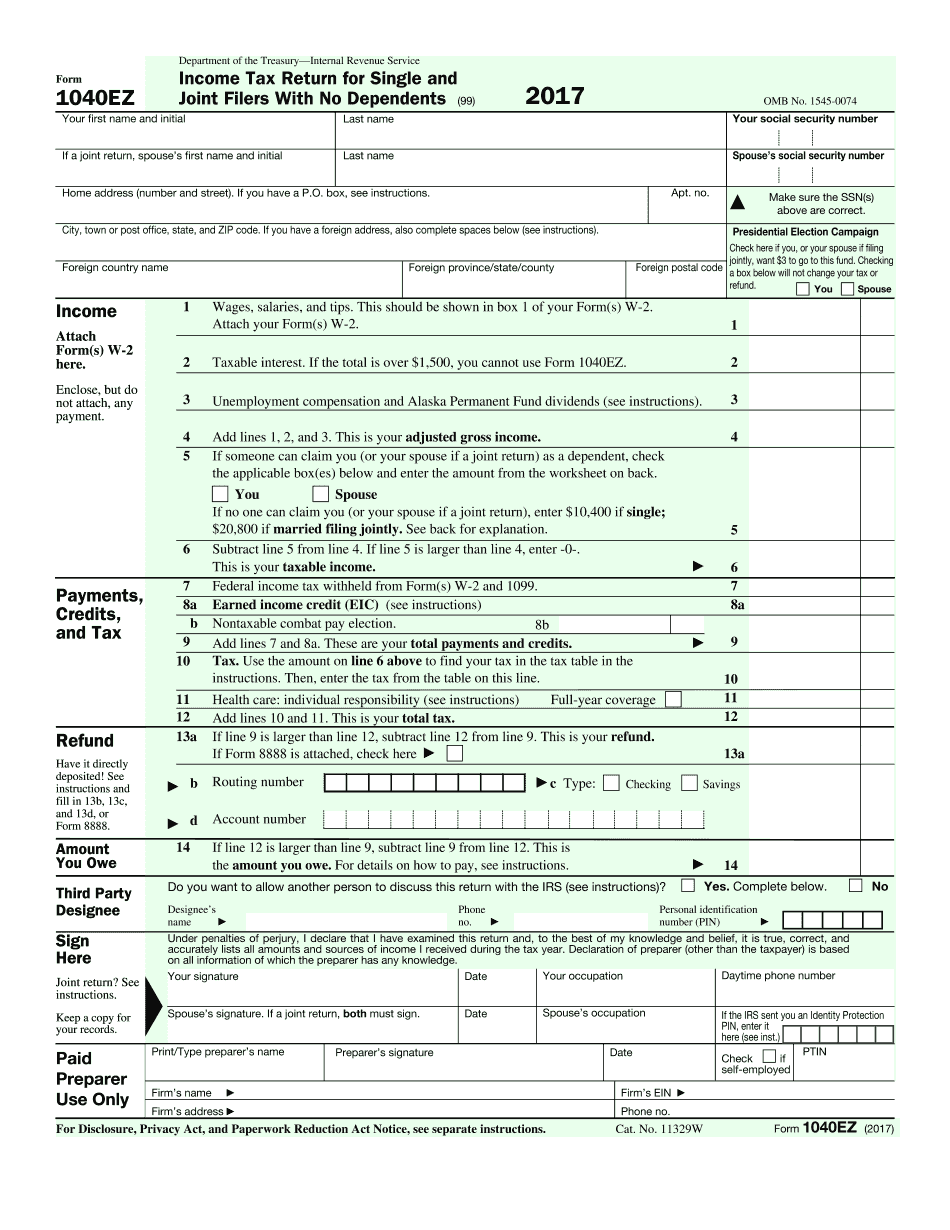

What is 1040ez Form?

You could use Form 1040-EZ if all of the following apply. You are filing as single or married filing jointly. Your taxable income is less than $100,000. You don't claim any dependents.

How to start Form Typer for 1040ez Form

Editing and managing PDF files look complicated. However, with our Form Typer for 1040ez Form, you can handle it in a few clicks. A set of tools helps you insert and delete content, work on text and manage pages. The solution is web-based, so you don't have to clutter up your device's memory with another app. Visit our website from any browser and use it without a hitch.

- Open your PDF to start working on in an online editor.

- Complete the form by filling in the fillable fields or using the Text option.

- Pick a tool from the menu bar and use it in the document.

- Insert images, add annotations, place checkmarks, erase or highlight text, and so on.

- Take advantage of the Search feature to navigate the file faster.

- Place your signature and date.

- Click Done to finish the process.

Get the most out of our Form Typer for 1040ez Form and explore more benefits to simplify your workflow. Create, complete and sign your forms seamlessly regardless of the device or operating system you use. Try out the solution now and leave all document-related issues behind.

Benefits of trying our Form Typer for 1040ez Form

If you need Form Typer for 1040ez Form, then our solution is for you. On the platform, you can completely edit and manage your PDF even faster and more conveniently than a hard copy. Your finished document can be downloaded, mailed, or printed. This is just a fraction of what you can do with one service. The toolkit helps you modify and work on content like a pro without installing extra software and app. Start using our solution now to check other editor's features and additional benefits of our service.

- Secure workflow

- Regular access to data

- Advanced editor

- Web-based solution

- User-friendly interface

Available from any device:

- Smartphone or iPhone

- Tablet or iPad

- Laptop or PC

Need a template of 1040ez Form?